Gold, which has been on the raise against the backdrop of the U.S.-led NATO proxy war against Russia’s full-scale invasion of Ukraine, has reached a historic milestone. Gold bars now reach $1,000,000. The precious metal, which is used as a store of value, especially during hard times, hit $2,528 per troy ounce, surging past its previously established record on August 2nd, 2024. Since the average bar weighs no less than 400 ouches, the value of a single gold ingot is worth $1,011,200.

In June, the Financial Times noted a sharp difference in opinion over the role of gold as a share of global reserves from this year to last. In 2023, only 38% of respondents in a survey of rich countries’ central banks believed that gold share of global reserves will rise in the next five years. This year the amount is 68% (i.e., more than half).

The scale of the new share of global reserves in gold is also unprecedented. In a recently published article by the Wall Street Journal noted how “Central banks have added around 2,200 tons of the metal since the third quarter of 2022, according to the World Gold Council—an increase of nearly $170 billion at current prices. Central bank net purchases now account for more than a fifth of global gold demand or about twice the proportion between 2012 and 2021.

The fact that there is a not only thirty percent increase in less than a year’s time or that central banks are stockpiling more than 2,200 tons of the precious metal cannot be explained by an inherent feature of gold bars, the chemical composition of gold, or its value but by the breakdown in the global order. One aspect of this breakdown is the decision by the United States to impose sanctions on Russia as a result of the Ukraine war.

Published on May, 22nd this year, the Journal‘s title makes it clear what is causing this monumental shift in global reserves: “Gold’s New Allure? It’s Sanctions-Proof.” The author attributes the trigger to “Western sanctions on Russia after it invaded Ukraine in 2022.” Gold, “which is easy to stockpile beyond foreigners’ reach,” began to feature “prominently in Russia’s reserves before and especially after the invasion.” At the time of its publication, gold’s value reached beyond $2,400.

Alongside the growth in global reserves is another tendency. On July 9th, Bloomberg published an article entitled, “Countries repatriating in wake of sanctions against Russia.” Countries in Africa, for instance, are actively repatriating gold from the United States. In the African press, the daily, L’Économiste Maghrébin, published an article entitled: Le Sud rapatrie son or des Etats-Unis.

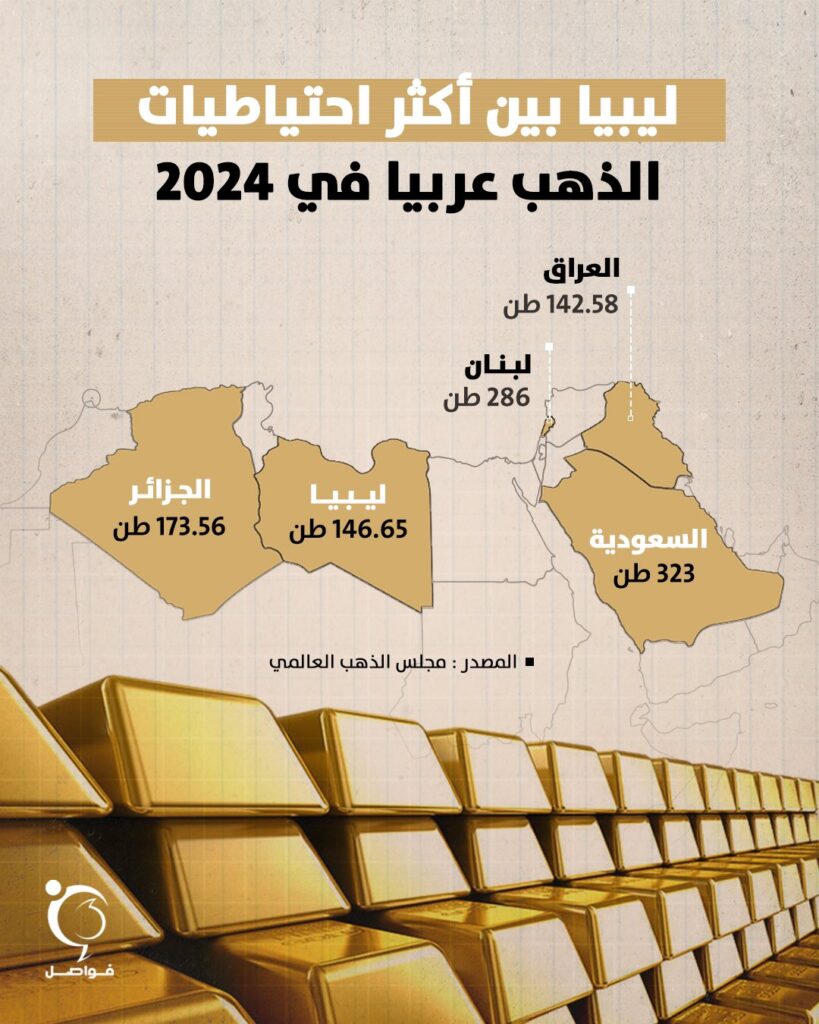

In an attempt to reassure that “[la] faillite de la banque américaine Silicon Valley Bank n’aura aucune répercussion sur le système bancaire tunisien,” L’Économiste Maghrébin noted how “la Banque Centrale de Tunisie” implemented new policies to safeguard the status of its system against the American financial system in the face of the regional banking turmoil. One of these new polices became the repatriation of gold reserves. Tunisia, however, is not the only African country to repatriate its gold reserves. Alongside Tunisia, which shares a border with Algeria as well as Libya, two of the largest Maghreb countries in north Africa, many other African countries have implemented similar, if not identical policies. These countries are: le Nigeria, l’Afrique du Sud, le Ghana, le Sénégal, le Cameroun, l’Algérie, l’Égypte et l’Arabie saoudite. Both l’Algérie et l’Arabie saoudite rank among the Arab nations with the largest tonnage in gold reserves, indicating that the issue is less a matter of the reserve than another matter altogether.

One of the factors contributing the rise in the value of gold is the replacement of the dollar as a global reserve currency. This is not only in response to the United States in its imposition of sanctions on Russia but also in response to the weaknesses of the dollar.*

Essentially underlying the drive to replace the dollar with gold there are six factors. The first is the decision to reverse the Bretton Woods Conference. The second is the Federal debt. The third is the collapse of American banks in 2023 starting with Silicon Valley Bank. The fourth is the untamable gyrations in inflation. The fourth is the decision to settle oil contracts in a currency other than the dollar together with a drive by the organization called Brazil, Russia, India, China, South Africa (i.e., BRICS) to encourage countries to settle contracts for oil as well as other commodities in a local currency rather than the dollar. The fifth is war.

- On August 15, 1971, President Richard M. Nixon announced a New Economic Policy, a programatic political agenda designed “to create a new prosperity without war.” Known within political circles as the so-called “Nixon shock,” the initiative marked the beginning of the end for the Bretton Woods system of fixed exchange rates established at the end of World War II for dollar to be converted into a troy ounce of gold.

- The Federal debt, which is expected to reach more than $65 to $70 trillion dollars within the next ten years, is perceived, whether true or not, by the world to be in a state of intractable expansion. Despite efforts to stimulate the reclamation of unpaid corporate taxes, the amounts the Internal Revenue Service are expected to collect fall short of the trillions of dollars the government needs to remain solvent. Just handle the Federal debt, the US is spending more than $2 billion a day on interest payments. America’s indebtedness is so intractable that the US must borrow more money today to pay the interest on yesterday’s debt.

- The rapid succession of collapse among regional banks, which continues, albeit in a more muted fashion than any time previously witnessed in the reporting on bank failures, witnessed the fall of many ‘regional banks,’ such as Silicon Valley Bank, Signature Bank, and First Republic, just to name a few. In a sign of the pervasiveness of the bank failures, Bloomberg published on June 11th, 2024, stating: “More US Regional Bank Failures May Be Coming.”

- Inflation, which has gyrated, has caused the U.S. Treasury to raise or to refuse to raise interests rates over the course of the past two years in an attempt to prevent untamable inflation but the gyrations in inflation continue.

- The war in the Gaza Strip, which has been raging since October is 7th, 2023, continues against the backdrop of America’s deteriorating relationship with Saudi Arabia.

This last cause is the most salient cause driving the replacement of the dollar. In an article published by the news monitoring agency, תיק דבקה, on March 7th, 2022, the author, who died in 2023, mentioned how the Saudi Crowned Prince Mohammed ben Salman (i.e., MbS) refused to answer a desperate call from the Biden administration over the rising price of oil (which began to approach $134 a barrel at the time) as a result of sanctions against Russia. The author mentions how MbS received an offer from the Chinese President Xi Jinping to settle oil contracts with China in the Chinese Yuan in exchange for a catalogue of Chinese weaponry MbS could receive at will.

In a sign of the seriousness of these allegations, the number of non-dollar contracts for settling transactions for commodities such as oil are on the rise. In a recent article published by the Wall Street Journal entitled “The Dominant Dollar Faces Competition in the Oil Market,” the newspaper reported how no less than “[twelve] major commodities contracts settled in non dollar currencies in 2023, compared with seven in 2022.” In the period from 2015 to 2021 there were only two contracts settled in a currency other than the dollar. This is, indeed, a sharp rise in comparison to the period immediately following Israel’s 60 day war in the Gaza Strip in 2014.

It points to a shift in the global standing of the United States throughout the Middle East, most especially in the territories of the former Ottoman Empire. Israel and Saudi Arabia figured prominently into to the Ottoman Empire’s 1638 borders. These countries, which to a certain extent have benefited from America’s geopolitical standing after WWII, have strayed as American power has. The original deal struck by Franklin D. Roosevelt in 1945 with the King Abdulaziz Ibn bin Saud, for instance, no longer holds sway in many negotiations, including but limited to oil.

After nearly a year of war in the Gaza Strip, Saudi Arabia, for instance, declined to renew the famous treaty established by Franklin Eleanor Rosevelt to trade oil in so-called petrodollars or to settle oil contracts exclusively in dollars, ending one of the most powerful aspects of America’s geopolitical power on the world scene.

With these five factors, none of which find a solution within the capitalist system, underlying the drive to replace the dollar, gold as a global reserve is expected to continue to rise in value not just now but over the course of the new few years. More and more countries are willing to pay the rising price for gold.[1] Should the United States facilitate Israel’s attack on Lebanon, a development witnessing the assassination of leader after Hizbollah leader, or refuse to ensure the Ukraine war ends with a negotiated settlement with a provision for the reversal of sanctions imposed as a result of the war not just on Russia but even America’s allies, the continuation of war is expected to exacerbate the drive to replace the dollar.

* The propensity to exploit the frozen assets of sanctioned countries such as Russia or its friends, trade partners, or allies, extending throughout the areas of geopolitical struggle, is also one of the processes deeply embedded in the sanctions and also driving the decision to abandon the dollar and its global financial system. In a report on Libya entitled, “The European Legion’s Activities in Libya,” James Wilson, for instance, details an unmentioned but wildly intriguing decision to transform frozen assets into a war chest for a proxy force. The Libyan news agency picked up the story, reporting: “وأشار التقرير إلى معاناة #إيطاليا الشديدة من قضية الهجرة، وتقود هذا التحالف وتتولى تشكيله منذ أشهر، ونظرا لعجزها عن دفع تكاليف الفيلق الأوروبي المالية، فقد ورد أنها استخدمت الأموال الليبية المجمدة في الخارج لتوفير السيولة اللازمة لتأسيسه.” Libya is the first country after Russia and in the ambit of Russia’s sphere of influence to witness the exploitation of its frozen assets by a European power for a proxy force.[2]

[1] – [Rich countries plan to buy more gold despite record price, Financial Times, June 18th, 2024]

[2] – [@fawaselmedia: status/1826373489303204276]